Investing can feel scary in the beginning and honestly, that’s very normal. When you hear words like stocks, mutual funds, real estate, crypto, or digital assets it’s natural to feel overwhelmed and confused. Most of us have been there.

But actually you don’t need to be a financial expert to start growing your wealth. One of the simplest and most beginner friendly way to invest is through mutual funds.

Mutual funds let you start small, learn gradually, and build wealth over time without the need to track the stock market every day. Think of mutual funds as a shortcut where experts manage the investments for you, while you sit back and let your money grow eventually.

In India, more and more people are investing in mutual funds and it is gaining popularity widely. From parents planning their kids’ education and marriage to young professionals thinking about retirement (yes, we all eventually need to think about it, so better start early!), mutual funds have slowly become an ideal option for investment and the best part is you don’t need to be a market genius to start.

By understanding a few basics, you can gain the confidence to invest without getting lost in jargons, confusing charts, or advice that sounds confusing. Once you understand it, you’ll realize investing isn’t only for experts rather it’s for anyone who wants their money to quietly grow in the background while they live their life.

What is a Mutual Fund?

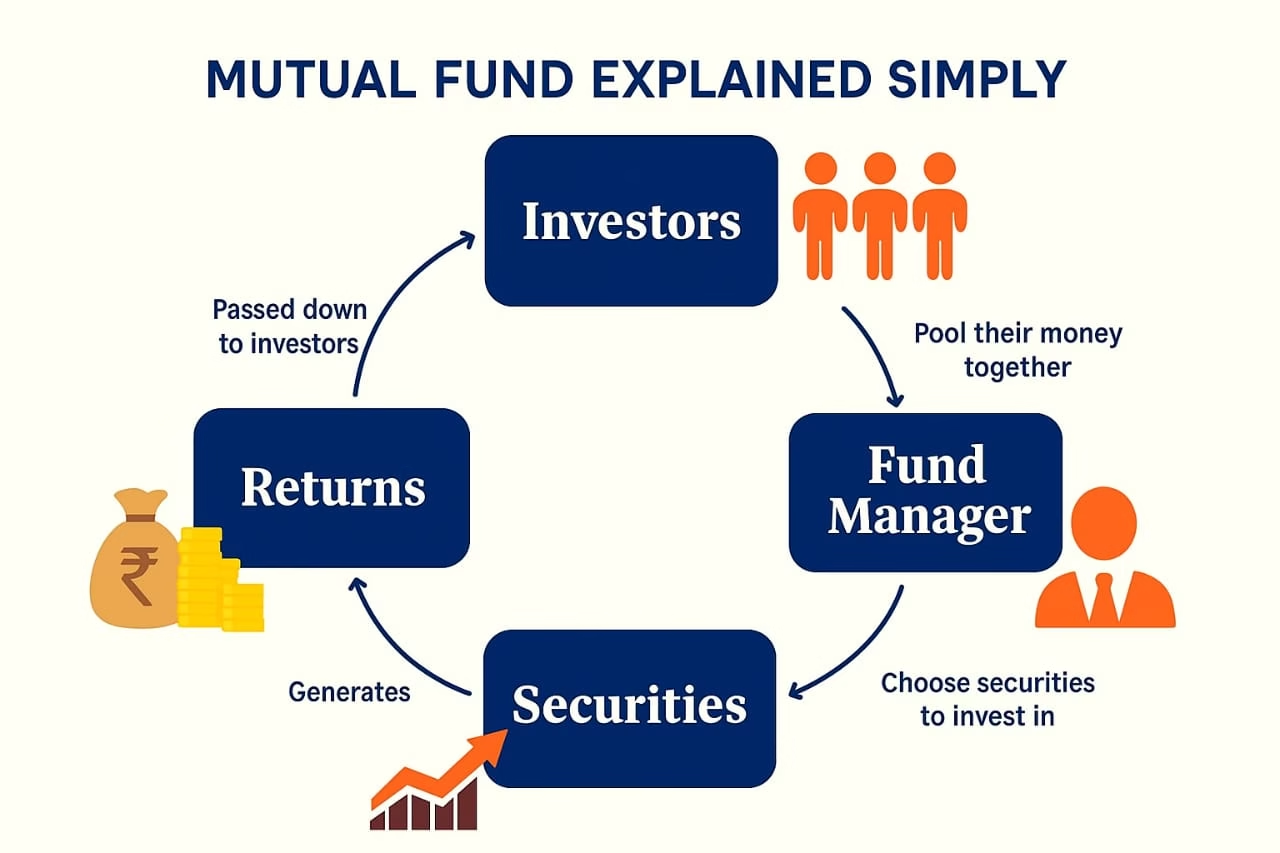

Think of it like a money teamwork club. Instead of trying to invest alone, many people put their money together in one big pool. This pooled money is then handled by a professional known as a Fund Manager, whose fulltime job is to study the market and make smart investment decisions. In short — People put in money, a fund manager invests it in different places — stocks, bonds, etc. and whatever profit is made gets shared among all investors, based on how much each person invested.

Let’s understand this in a better manner with a simple example:

Now imagine there are 1,000 people who have invested ₹10,000 each. Now the mutual fund has ₹1 crore in total. The fund manager uses this ₹1 crore to invest in different companies and assets as per the fund objective. If the investments do well, everyone earns. If markets go down, everyone shares that risk too, but the impact is usually smaller because the money is divided across many investments. Thus, mutual funds let even regular investors start small and still enjoy expert management and diversification which is tough and time-consuming to do on your own.

Why Should You Invest in Mutual Funds?

If you’re just starting your investment journey, mutual funds can be a great first step. Investing in mutual fund is easy and beginner-friendly. Here’s why:

- Experts do the hard work for you.

You don’t need to spend hours reading market news or analysing stocks. Smart fund managers handle all that research and decision making for you.

- Your money isn’t sitting in one basket

Mutual funds spread your money across different investments so even if one company doesn’t do well, others can balance it out.

- Options for every type of investor

Whether you’re cautious, adventurous, or somewhere in between, there’s a fund for your comfort level. Equity, debt, hybrid, index… you choose based on your goals and risk appetite.

- Easy to withdraw whenever needs arise.

Most mutual funds let you take out your money quickly. So if there’s an emergency, you aren’t stuck waiting.

- Start small

No need to have lakhs. Even ₹500 through a SIP is enough to begin with.

Here’s a story for you

Meet Anjali — a young teacher in Pune. She wanted to invest but didn’t know much about the stock market and didn’t have a big budget. So she began with just ₹1,000 a month in a hybrid fund. Slowly and steadily, she watched her money grow. Over 5 years, not only did she have a decent amount of funds invested, she also gained confidence. That’s when she felt ready to try equity funds for her long-term dreams.

Her journey started small, but it changed her mind set and her financial future.

Types of Mutual Funds in India

Not all mutual funds are the same, each type has a different purpose. They can be classified on various basis. The most popular ones are as follows:

Equity Funds

These funds invest mostly in stocks, they can grow your money the most but they also fluctuate the most. These funds are Ideal for long term wealth creation. Such as retirement or buying a house.

Types of Equity Funds

Indian equity market is divided across three categories:

- Large cap fund: Funds which invest in Top 100 companies as per market cap are considered as large cap funds. Large cap funds are considered as the most stable equity category in-terms of market volatility since it can only invest in top 100 companies.

- Mid cap fund: Companies ranked from 101-250 (in-terms of market cap) are considered as mid cap companies. Mid-cap funds are those which invest mostly in shares of such companies. These are considered a bit riskier because many mid-sized companies don’t yet offer the same stability and consistency that large, well-established companies do. They have strong growth potential, but they can also face more ups and downs along the way.

Mid caps are like fast-growing businesses still strengthening their foundation, while large caps are already stable and proven leaders. But many mid-cap companies also have the potential to grow and eventually become large cap giants. So while mid-cap funds come with slightly higher risk compared to large cap funds, they’ve also historically delivered better returns over the long term.

Mid-caps offer the right mix of growth and opportunity to long term investors. - Small cap fund: In terms of risk small cap funds are considered as very risky because they invest in companies that are ranked from 251( in-terms of market cap) and below.

Note that equity funds itself is a risky asset class so it is very important to understand one’s risk appetite before investing.

Debt Funds

These invest in bonds and government securities, basically lending money to companies/government and earning interest.

- Best for: Short-term to medium-term goals

- Risk: Lower than equity funds

- Reward: Stable returns

Examples: Liquid funds, corporate bond funds, short-term debt funds

Hybrid Funds

These are a mix of equity and debt, so they give you growth plus stability — a balanced approach.

- Best for: For peoples who wants stability yet better return than FD or debt funds.

- Risk: As hybrid fund consists of a mix portfolio of debt and equity, risks are considered to be much lower than equity.

- Reward: Balanced return.

Examples: Balanced advantage funds, equity hybrid funds.

Index Funds & ETFs

These simply copy market indices like Nifty 50 or Sensex. No fancy stock-picking, they just track the market.

- Best for: Long-term investors who want simplicity & low cost, also some one who is new to the market.

- Risk: Market-linked

- Reward: Typically steady over long term

Examples: Nifty 50 Index Fund, Sensex ETF

Quick Tip

Your choice should depend on:

- Your financial goal

- How much risk you’re comfortable with

- For how long you want to be invested

People often ask, “Which is the best Mutual Fund to invest in?”

But honestly, there’s no universal best fund for everyone. What works perfectly for someone else might not suit you at all. Your investments should match your risk comfort, your goals, and how long you plan to stay invested.

So instead of searching for the best mutual fund, choose a fund that truly fits your life and your money journey.

There’s no best fund, only the fund that best fits you.

How to Start Investing in Mutual Funds

Most people think investing is complicated- forms, documents, financial jargon, but what matters most is simply getting started.

Let’s break it down step-by-step:

Step 1: Complete Your KYC

KYC = “Know Your Customer” is the government verifying you’re a real person, not a robot trying to invest. You’ll need:

- PAN card

- Aadhaar or address proof

These days, you can finish KYC online in a few minutes with just an Aadhaar OTP or a quick video verification and you’re done. No long queues, no paperwork headache.

KYC is mandatory for all mutual fund investors. It’s quick but many beginners get confused.

To make it easier, I’ve written a detailed KYC guide so check it out if you need help.

Step 3: Choose Where to Invest

- You can invest through: Apps/Websites like Groww, Coin by Zerodha Angel One, Paytm Money .

- Banks like HDFC, SBI, ICICI.

- SEBI Certified Mutual Fund Distributors

Also, you’ll see two options:

| PLAN TYPE | MEANING | BEST FOR |

| Direct plan | No commission, lower fees, higher returns | Self-learners |

| Regular plan | Includes agent fee, slightly lower returns | Investors who want help |

- If you’re okay doing a bit of reading and have the time, choose Direct Plans

Step 3: Pick How You Want to Invest

There are two ways:

- Lump-Sum

You can invest a big amount at once. This is best if you already have savings and don’t mind market ups & downs.

- SIP — Systematic Investment Plan

You can also invest a small fixed amount every month say ₹500 or ₹1,000. SIP helps in building discipline, handling market ups and downs smoothly and is great for beginners .

Step 4: Match Funds With Your Goals

Funds should not be selected randomly rather it should be matched to how long you want to invest:

| TIME HORIZON | BEST CHOICE |

| 1-3 years | Debt or liquid funds |

| 3-5 years | Hybrid funds |

| 5+ years | Equity funds ( for maximum growth) |

Real-Life Style Example

Kiran wanted to buy a car in 3 years. So she picked a short-term debt fund which is safer and steady. At the same time, she started a SIP in equity funds for her child’s education, which is 10+ years away.

Step 5: Keep an Eye On Your Investments (Without Stressing)

You don’t have to check your investments every day. You can review them every 3 months and check how your fund is performing, compare it with the fund’s benchmark.

Note: Markets go up and down. That’s normal. Don’t panic and stop investing just because the return dips for a while.

Let’s see what Ramesh did

Ramesh, a software engineer, kept investing even during the 2022 market crash when everyone around him panicked and stopped. Fast forward to 2025 — not only did the market recover, his money grew much more because he stayed consistent.

Step 6: Diversify (Don’t Put All Eggs in One Basket)

Within mutual funds, variety helps reduce risk, so its better to mix equity + debt + hybrid funds. Within equity, you should always choose different sectors & market caps (large-cap, mid-cap etc.). In this way, if one fund dips, others balance it out.

- Just because one fund performed great in the past doesn’t mean it always will, it’s always wise to spread your money smartly.

- Past performance doesn’t guarantee future returns.

Step 7: Be Consistent & Patient

Mutual fund investing takes time. You cannot get rich in 2 months. Success comes from regular SIPs, ignoring temporary market volatility and staying focused on your long-term goal.

Step 8: Keep Learning consistently.

You don’t need to become a finance genius. But understanding basics like types of funds, market cycles, risk levels, goal-based investing will help you feel more confident and make smarter decisions over time.

Conclusion

Mutual funds are one of the simplest and safest ways for everyday Indians to build wealth because:

- You don’t need lakhs to start with.

- You don’t need to be a finance expert.

- You just need a plan, consistency, and patience.

- You can start small and immediately.

Your SIP of ₹500 a month can grow into something meaningful over the years.

- Do your KYC

- Pick a suitable fund

- Start a SIP in that fund

- Stay consistent

Your future self will thank you. Because every rupee you invest today brings you one step closer to financial freedom.

Disclaimer: Mutual fund invests are subject to market risk. Please read all scheme related documents carefully before investing.

For regular personal finance related updates do follow us on Instagram and Facebook

For any queries Contact Us

1 thought on “How to Build a Long Term Wealth Through Mutual Funds”