Don’t miss out! See how gold vs silver have performed recently, which one’s leading, and where you should put your money before the next major rally.

You might have seen the ads, heard the chatter: “gold prices hitting new highs”, “silver rallying hard”, people talking about “safe havens.” But the problem is that if you pick the wrong fund at the wrong time, you could miss out on a big opportunity.

In the first half of 2025, silver was slightly ahead in the gold vs silver battle. If you had put money into both metals, silver would’ve made more gains, but with more gains come higher risk.

The question is: Will silver continue its rally? Or will gold prove it still holds the crown for long-term value? Let’s compare.

Historical Returns: Gold vs Silver

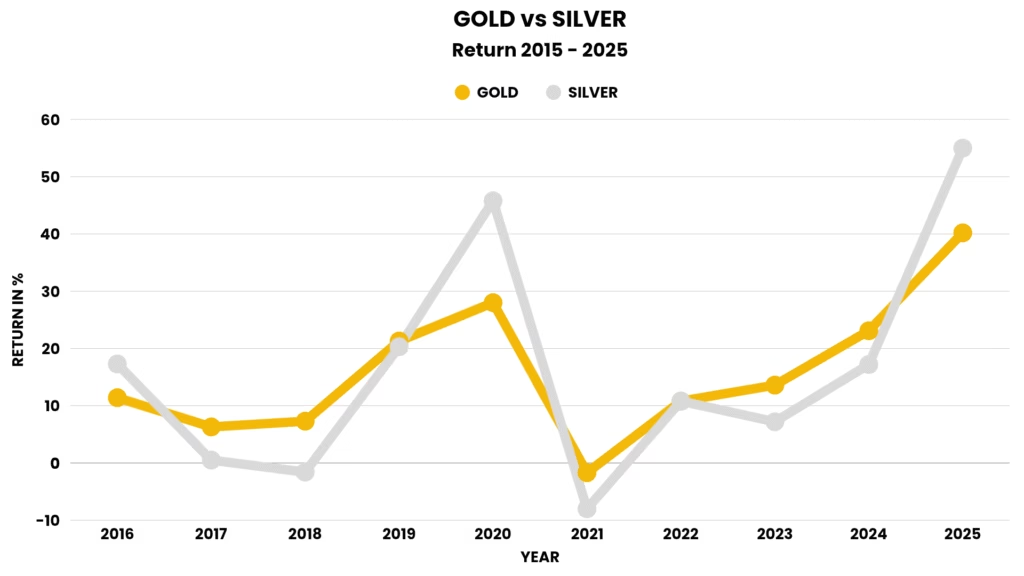

Here’s what the recent past tells us:

Long-Term Pattern: Precious metals (Gold & Silver) have dominated returns in recent past, outperforming many other asset classes.

Silver often gives higher short-term returns, but is volatile. On the other hand gold is steadier and less volatile.

Why Gold Stands Ahead of Silver

Even though silver has outperformed gold in 2025, gold is considered as more stable asset. As of June 2025 India’s household gold holding is estimated around 34600 tones valued at $3.8 trillion which is nearly 88.8% of India’s GDP.

There is a significant reason for that as well. In India gold has its own religious, cultural and sentimental values. Gold isn’t just a metal for us rather it’s emotion and tradition. We love gifting it to our relatives and special ones on festivals, weddings, and important milestones. It’s a way of showing love, blessings, and security. In our culture, buying gold isn’t only about wealth — it’s also believed to bring good luck and prosperity, which is why many families still prefer to buy gold on auspicious occasions.

Apart from that RBI (Reserve Bank of India) is also increasing their gold reserves due to global uncertainty. By March 2025 India’s central bank’s gold reserves stood at approximately 879.58 tones, 8th in the world. Not only India every country is looking to boost up their gold reserves since USA sanctioned Russian foreign reserves after the Russia Ukraine war started. As countries need both foreign reserves and gold to print currency, they are trusting gold over US dollar.

It’s a completely different story, when it comes to silver. Throughout human history, gold has been a secure, reliable and stable asset, from trading to printing currency. Silver, on the other hand has more industrial usage. Yes, we do use silver as jewellery or ornaments but it’s never been treated as a currency like gold.

So, we believe it’s not fair to compare gold vs silver as investment assets. Considering silver more like commodities and gold as asset makes more sense. If you are confused about what to buy between gold vs silver for investment purposes, a mix of both makes more sense. Don’t go overboard with just a one thing.

Pros & Cons

Pros of Gold:

- Safe haven asset during crisis

- Lower volatility, more stable

- Backed by central bank buying

- Highly liquid, easy to trade

- Long-term store of value

Pros of Silver:

- Higher upside potential in bull runs

- Strong industrial demand (electronics, solar, EVs)

- More affordable entry point

- Adds diversification to portfolio

Cons of Gold:

- Expensive entry price per 10g

- Slower returns when compared with silver/equities

- No major industrial use

- Requires safekeeping/storage costs

Cons of silver:

- Highly volatile, sharp price swings

- Bulkier to store (kg vs grams)

- Demand tied to industrial cycles

- Lower liquidity as compared to gold (not hoarded by central banks)

Where Silver Is Leading Right Now

Silver has recently hit record highs in many Indian cities, gold is also rising but silver’s percentage gains are attracting more eyes.

Risks You Can’t Ignore

The higher volatility means silver can drop sharply if industrial demand wanes (e.g. downturns, slowdown in solar/EV demand).

Storage, purity, transaction costs especially for physical silver can eat gains.

Market sentiment swings: When fear or economic uncertainty increases, gold tends to benefit more. Silver sometimes underperform under such conditions.

Regulatory/cost factors: Import duty, trading fees, etc. can affect silver more (because of smaller margins).

What the Graphs Would Tell You

If you compare gold vs silver returns over the last 10 years, you’ll see silver line rising more steeply in the recent short periods; gold’s line smoother.

What Should You Do?

If you want maximum gains in the short to medium term and are comfortable with risk – a balanced gold-silver portfolio might make sense.

If your goal is wealth preservation, hedge against inflation/geopolitical risk then better option will be gold plus maybe smaller silver allocation.

Consider using ETFs or digital gold/silver if you don’t want hassles of storage.

Diversify one’s exposure, and don’t put all “precious metals eggs” in one basket. Maybe 10-20% of portfolio max in metals.

Gold to Silver Ratio

When people talk about investing in precious metals, gold and silver are the ones that top the list. They’ve been trusted for centuries, from kings and traders in ancient markets to modern investors today. But how do you know when gold is better valued than silver, or vice versa?

One useful indicator is the Gold-to-Silver Ratio

This has been off late the talk of the town, so lets understand this.

What is the Gold-to-Silver Ratio?

The Gold-to-Silver Ratio is a simple ratio that tells us how many units of silver is equal to the price of one unit of gold. You can think of it as a price comparison tool.

- Formula: Gold price ÷ Silver Price.

For example, if 1 gram of gold costs ₹6,000 and 1 gram of silver costs ₹75 then 6000 ÷ 75 = 8 0So the ratio is 80:1. This means 1 gram of gold costs as much as 80 grams of silver.

Why is this ratio important?

Gold and silver both have their value, but as discussed earlier, both of them behave differently in the market. This ratio helps investors understand their relative value, it’s like checking whether apples are cheap compared to oranges in a fruit market.

- High ratio (example: 80:1 or 90:1) This means silver is cheaper as compared to gold and thus some investors may consider buying silver.

- Low ratio (example: 40:1 or 50:1)This means silver is expensive compared to gold. Gold may seem more attractive to some investors in this scenario.

This ratio doesn’t guarantee profits, it just gives an idea about market conditions and historical price behavior.

What does history say?

Historically, the ratio has mostly been around 60:1 –70:1. In certain periods, it has moved far above that level, especially in uncertain economic times, when gold usually becomes more attractive as a “safe-haven” asset. Investors can check these shifts to decide where they might get a better value.

How can everyday investors use this ratio?

You don’t need to be a market expert to use this. You can just track gold and silver prices weekly or monthly and notice whether the ratio is rising or falling. Combine this understanding with your financial goals. Many long-term investors diversify by holding both gold and silver through physical metal, digital gold, ETFs, etc. Always remember that the Gold-to-Silver Ratio is a tool, not a rule. Never invest only because the ratio is high or low, use it as one part of your decision making toolkit.

Conclusion

Gold vs silver doesn’t have a one-size-fits-all answer. In 2025, silver has been stealing headlines – bigger percentage gains, strong industrial demand, cheaper entry. But gold still holds value for those who want stability, trust, and safe-haven protection.

Don’t let the fear of missing out push you into a risky bet. Invest smartly, mix various investment instruments, understand your risk tolerance, watch industrial and global trends.

For more person finance related updates do follow us on Instagram and Facebook

For any queries Contact Us

1 thought on “Gold vs Silver in 2025: Who is the Ultimate Winner?”