What is PPF and Why Was It Introduced?

The Public Provident Fund (PPF) was introduced by the Government of India in 1968. Back then, Indians mostly relied on gold, post office savings, or fixed deposits. There was no reliable, long-term savings plan for the average family. To solve this, the government created Public Provident Fund with three key goals:

- Encourage small savings habits among ordinary citizens.

- Provide a form of retirement security, since India had no universal pension system.

- Offer safe, tax-saving returns backed by the government.

Even decades later, Public Provident Fund remains one of the most trusted investments for anyone looking for safety + tax benefits + steady growth.

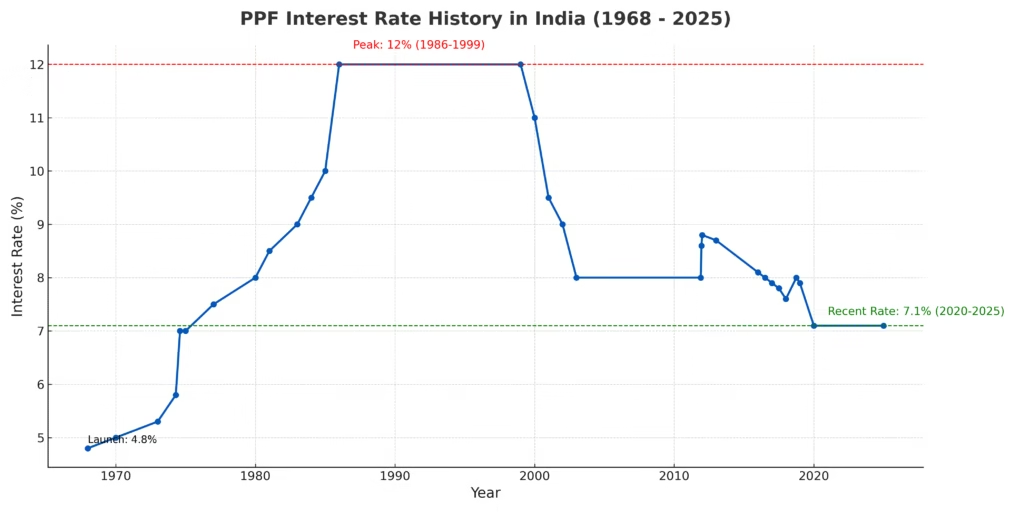

Historic PPF Interest Rates – From 1968 to 2025

Even though Public Provident Fund returns are on the lower side compared to equity, people still trust Public Provident Fund for the safety and peace of mind. One fascinating aspect of Public Provident Fund is how interest rates have changed over the years.

Here is the data for PPF returns over the years:

- Fun fact: In 1986, ₹1 lakh in Public Provident Fund earned ₹12,000 annually, compared to ₹7,100 today.

Key Features of PPF

- Tenure – Minimum 15 years, extendable in 5-year blocks.

- Minimum/Maximum Contribution – ₹500 to ₹1.5 lakh per year.

- Deposit Frequency – Lump sum or up to 12 installments yearly.

- Interest Rate (2025) – 7.1% (compounded annually, credited yearly).

- Tax Benefits – EEE (Exempt-Exempt-Exempt): tax deduction under Sec 80C, tax-free interest, and tax-free maturity.

- Safety – 100% government-backed.

Why PPF Still Matters in 2025

In the 90s Public Provident Fund returns were at 12%, generally people who invested in Public Provident Fund at that time was able to generate create a meaningful corpus for their retirement. If you ask your parents, more often they will say “Beta, start your PPF early.”

Today, even at 7.1%, I still consider Public Provident Fund a must-have. Why? Because it’s the financial equivalent of a solid foundation — not exciting, but it keeps your portfolio stable.

Who Can Open a PPF Account?

- Any Indian resident individual can open one account.

- Minors can have a Public Provident Fund account through a guardian.

- NRIs and HUFs (Hindu Undivided Families) are not eligible.

Where to Open a PPF account

- Post office: Post offices offers Public Provident Fund accounts and also it is probably the most widespread network, especially in rural areas.

- Banks: Nationalized bank like SBI, PNB and Bank of Baroda allows you to open Public Provident Fund account. Some private banks like HDFC, ICICI bank and Axis bank also allows you to open Public Provident Fund F account.

You can also open an online Public Provident Fund account from respective bank’s internet banking page or mobile banking app.

Documents Required

To open a PPF account you will only need these documents:

- PAN card

- AADHAAR

- Bank account details

Tax Benefits of PPF

PPF account holders enjoys EEE (exempt, exempt, exempt)status:”

- Exempt at Investment: Contributions up to ₹1.5 lakh deductible under Section 80C.

- Exempt on Growth: Interest earned is tax-free.

- Exempt at Withdrawal: Maturity proceeds are fully tax-free.

These are the biggest benefits of PPF. Very few instruments in India has this triple exemption.

Withdrawal Rules You Should Know

One of the drawbacks of PPF is the lock-in period. You have to keep it for atleast 15 years. But there are some exceptions as mentioned below.

- Partial Withdrawals: Allowed from the 7th financial year.

- Loans Against PPF: Available between the 3rd and 6th year.

- Premature Closure: Allowed after 5 years for specific cases (medical needs, higher education, etc.), with a 1% interest penalty.

Maturity: Full amount withdrawable after 15 years, with an option to extend in 5-years blocks.

Pros and Cons of PPF

Pros:

- Government-backed safety.

- Tax-free returns.

- Long-term wealth creation.

- Ideal for conservative investors.

Cons:

- Lock-in of 15 years (low liquidity).

- Interest rates can change (currently lower than past decades).

- Maximum deposit capped at ₹1.5 lakh per year.

Final Word

The Public Provident Fund has stood the test of time since 1968. It may not give the dazzling 12% returns of the past, but even at 7.1%, it’s probably the most safest and most tax-efficient investment options in India.

If you’re building your financial portfolio in 2025, PPF deserves a place. Think of it as your financial safety net — slow, steady, and reliable.

For regular personal finance updates do follow us on Instagram and Facebook

For any queries Contact Us