GST reform brings relief on essentials, but is it enough? Let’s find out what’s cheaper in 2025 and where the reform may fall short.

56th GST Council Meet Highlights

- New rates from Sept 22

- 2 slabs approved: 5% & 18%

- Sin goods and luxury items : 40%

- Expected revenue shortfall due to GST cuts: ₹93,000 cr

- Expected gains from 40% slab: ₹45,000 cr

On September 3rd 2025, GST council of India announced the new GST bill. The “Next–gen GST Reform”. It will be implemented from 22nd September 2025.

Why Now?

This GST reform might be more than just a tax cut — it could be a way to balance global trade, especially with the U.S. implying a 50% tariff on Indian goods.

A GST cut may serve many purposes:

- Boost domestic consumption when exports fall.

- Help industries clear excess stock.

- Give customers relief in prices.

- Support jobs by keeping factories active.

- Make Indian goods more competitive in price

Is it Truly a “Historic Diwali Gift For the Nation”? Let’s Break it Down:

The GST reform 2025, has significantly reduced GST rates on some of the key items. Let’s have a quick look on those items and their impact on the overall Indian economy.

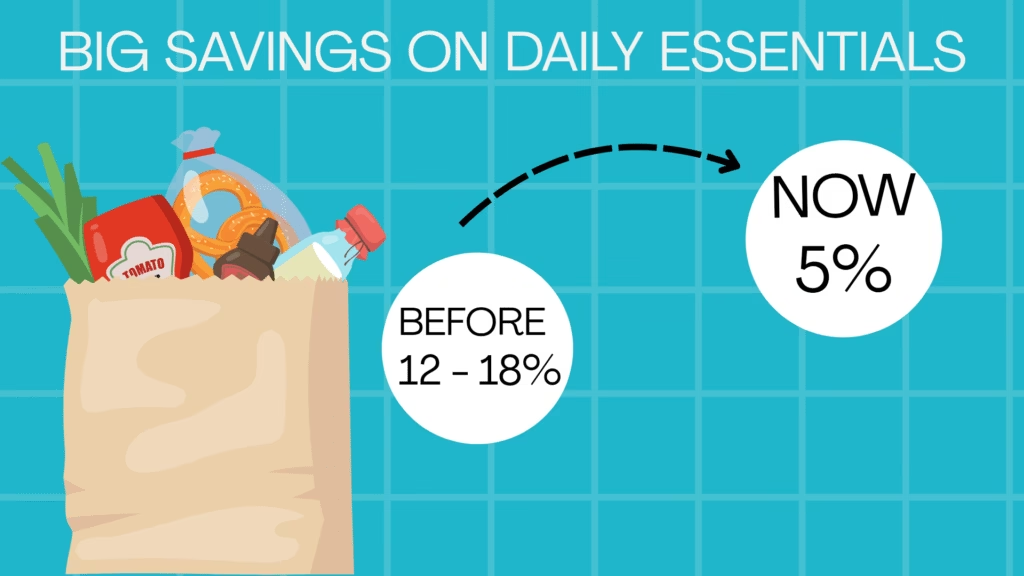

Save Big on Daily Essentials

- Hair Oil, Shampoo, Toothpaste, Toilet Soap Bar, Tooth Brushes, Shaving Cream: 18% → 5%

- Butter, Ghee, Cheese & Dairy Spreads: 12% → 5%

- Pre-packaged Namkeens, Bhujia & Mixtures: 12% → 5%

- Utensils: 12% → 5%

- Feeding Bottles, Napkins for Babies & Clinical Diapers: 12% → 5%

- Sewing Machines & Parts: 12% → 5%

This could have a huge positive impact on Indian FMCG sector.

Uplifting Farmers & Agriculture

- Tractor Tyres & Parts: 18% → 5%

- Tractors: 12% → 5%

- Specified Bio-Pesticides, Micro-Nutrients: 12% → 5%

- Drip Irrigation System & Sprinklers: 12% → 5%

- Agricultural, Horticultural or Forestry Machines for Soil Preparation, Cultivation, Harvesting & Threshing: 12% → 5%

The prices of fruits and vegetables could come down due to the new reform, leading to lower inflation and potentially higher income opportunities for farmers.

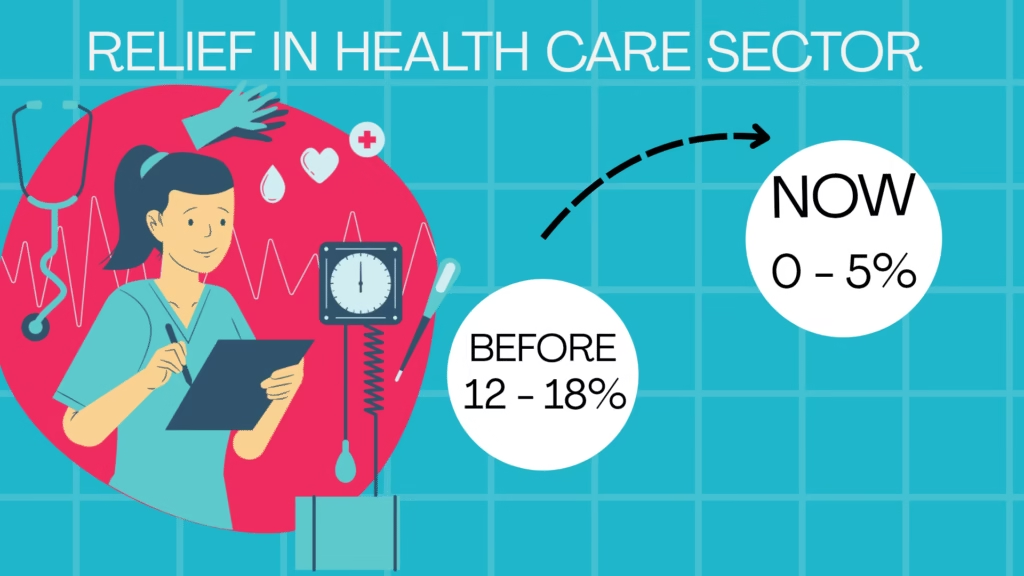

Relief in Healthcare Sector

- Individual Health & Life Insurance: 18% → Nil

- Thermometer: 12% → 5%

- Medical Grade Oxygen: 12% → 5%

- All Diagnostic Kits & Reagents: 12% → 5%

- Glucometer & Test Strips: 12% → 5%

- Corrective Spectacles: 12% → 5%

- Medical, dental, and veterinary devices: 18% → 5%

Important: GST has been reduced from 12% to NIL on 33 lifesaving drugs and medicines, and from 5% to NIL on 3 essential drugs used for the treatment of cancer, rare diseases, and other severe chronic conditions.

GST on other medicines including Ayurveda, Unani, Homoeopathy medicaments decline from 12% to 5%.

For individuals or families undergoing such treatments, this reform can significantly reduce medical expenses, making quality healthcare more affordable.

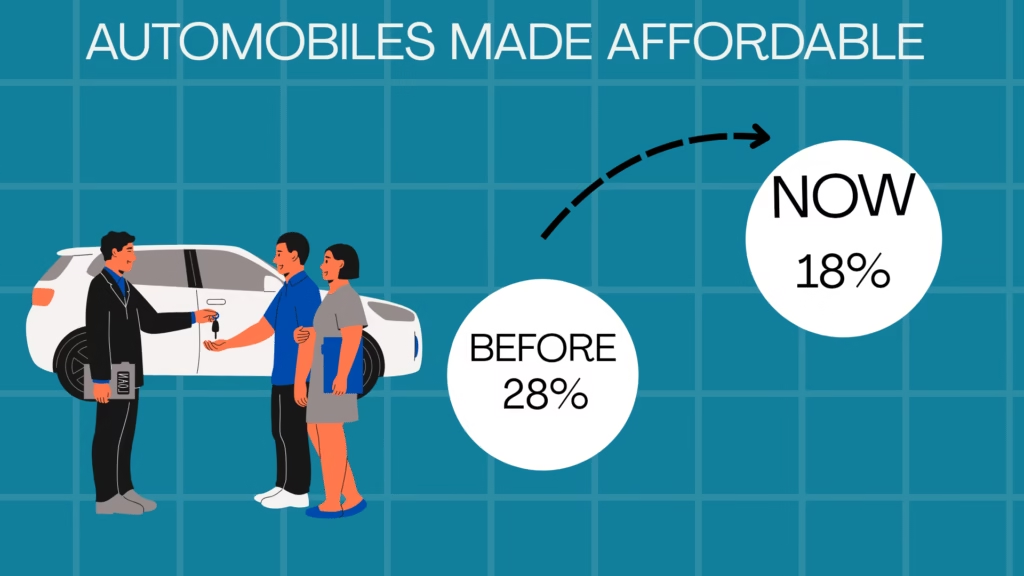

Automobiles Made Affordable

- Petrol & Petrol Hybrid, LPG, CNG Cars (not exceeding 1200cc & 4000mm): 28% → 18%

- Diesel & Diesel Hybrid Cars (not exceeding 1500cc & 4000mm): 28% → 18%

- 3-Wheeled Vehicles: 28% → 18%

- Motor Cycles (350cc & below): 28% → 18%

- Motor Vehicles for Transport of Goods: 28% → 18%

With GST on motor vehicles coming down, this could boost not only car sales but also increase demand for petrol, diesel, CNG, tyres, and other auto parts.

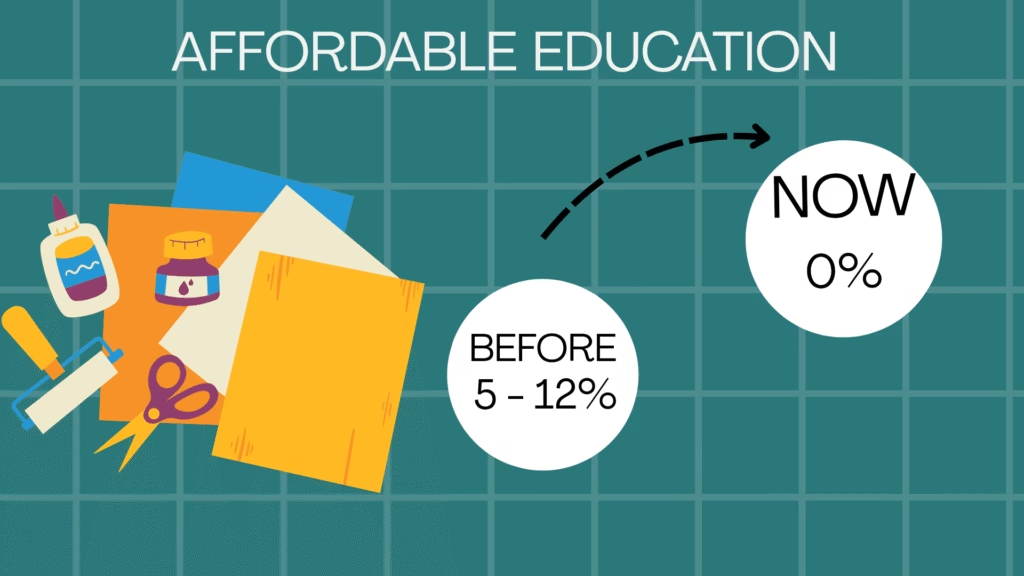

Affordable Education

- Maps, Charts & Globes: 12% → Nil

- Pencils, Sharpeners, Crayons & Pastels: 12% → Nil

- Exercise Books & Notebooks: 12% → Nil

- Eraser: 5% → Nil

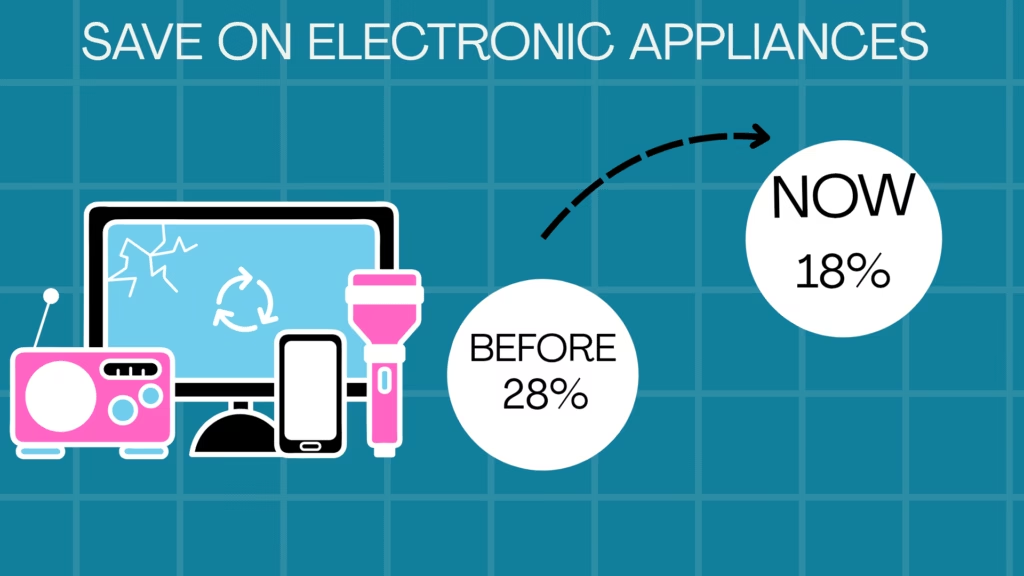

Save on Electronic Appliances

- Air Conditioners: 28% → 18%

- Television (above 32”) including LED & LCD TVs: 28% → 18%

- Monitors & Projectors: 28% → 18%

- Dish Washing Machines: 28% → 18%

Home Building and Materials

- Cement: 28% → 18%

- Marble/travertineblocks, Granite blocks, Sand-lime bricks: 12% → 5%

- Bamboo flooring / joinery, Packing cases & pallets (wood): 12% → 5%

Service Sector

- Hotel stays up to ₹7,500/day: 12% → 5%

- Gyms, salons, barbers, yoga GST cut : 18% → 5%

Toys, Sports & Handicrafts

- Handicraft idols & statues: 12% → 5%.

- Paintings, sculptures: 12% → 5%

- Wooden/metal/textile dolls & toys: 12% → 5%

What’s Getting Expensive

Not every sector is getting a GST cut. The GST council now has decided to increase GST rates on some products. As they call it sin goods and luxury items. Here are some of those items which are getting a GST hike upto 40%. But from now on there will be more CES charges applicable.

Sin Goods and Luxury Items

- Carbonated Beverages of Fruit Drink or Carbonated Beverages with Fruit Juice: 28% → 40%

- Caffeinated Beverages: 28% → 40%

- All goods [including aerated waters], containing added sugar or other sweetening matter or flavoured: 28% → 40%.

- Tobacco, gutkha, pan masala, ciggerate: 28% → 40%.

- Unmanufactured tobacco; tobacco refuse [other than tobacco leaves]: 28% → 40%

- Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

- Other manufactured tobacco and manufactured tobacco substitutes; “homogenised” or “reconstituted” tobacco; tobacco extracts and essences : 28% → 40%

- Products containing tobacco or reconstituted tobacco and intended for inhalation without combustion: 28% → 40%

- Products containing tobacco or nicotine substitutes and intended for inhalation without combustion: 28% → 40%

- Revolvers and pistols, Smoking pipes (including pipe bowls) and cigar or cigarette holders, and parts thereof: 28% → 40%

- Motor cars and other motor vehicles principally designed for the transport of persons, including station wagons and racing cars. Motor vehicles with both spark-ignition internal combustion reciprocating piston engine and electric motor as motors for propulsion, of engine capacity exceeding 1200cc or of length exceeding 4000 mm. Motor vehicles with both compression-ignition internal combustion piston engine [diesel-or semi diesel] and electric motor as motors for propulsion, of engine capacity exceeding 1500cc or of length exceeding 4000 mm. Motor cycles of engine capacity exceeding 350. Aircraft for personal use. Yacht and other vessels for pleasure or sports: 28% → 40%

- GST on high-value apparel, clothing accessories, and certain textile products exceeding Rs. 2,500 per piece has increased from 12% to 18%, making luxury textile items more expensive for consumers.

From the Union Budget to RBI rate cuts, and now this GST reform — everything points in one direction: boosting domestic consumption. With the US imposing 50% tariffs on Indian products, this reform could help exporters by strengthening demand within India.

As India’s inflation hits lowest in 8 years it will not be a surprise if RBI decides to cut the REPO rate one more time in this financial year. Considering the income tax reduction earlier this year, now people might start spending on other than just essentials. This could result in sales volume growth in sectors like FMCG, consumer durables, consumer discretionary & automobile sector.

Also the festive season is around the corner, some experts are saying the timing of this new GST bill couldn’t be any better. However the results might take time to reflect as the new GST will be affected from 22nd September. We might have to wait a little more to see how much of an impact it could create in real life.

For regular personal finance related updates do follow us on Instagram and Facebook .

For any queries Contact Us