Don’t let KYC hold you back. Discover the simple process to get approved and invest in mutual funds smoothly.

Mutual funds are one of the most popular ways for Indians to build wealth. But before you start investing, there’s a crucial compliance step you can’t skip — Know Your Customer (KYC). This verification, mandated by the Securities and Exchange Board of India (SEBI), ensures your identity and financial details are properly recorded before you become an investor.

This customer verification process helps confirm that investors are genuine, reducing the risk of fraud, money laundering, and other financial irregularities. In this article, we’ll explore what Know Your Customer means, why it’s important in investing, and the simple steps to complete the process smoothly.

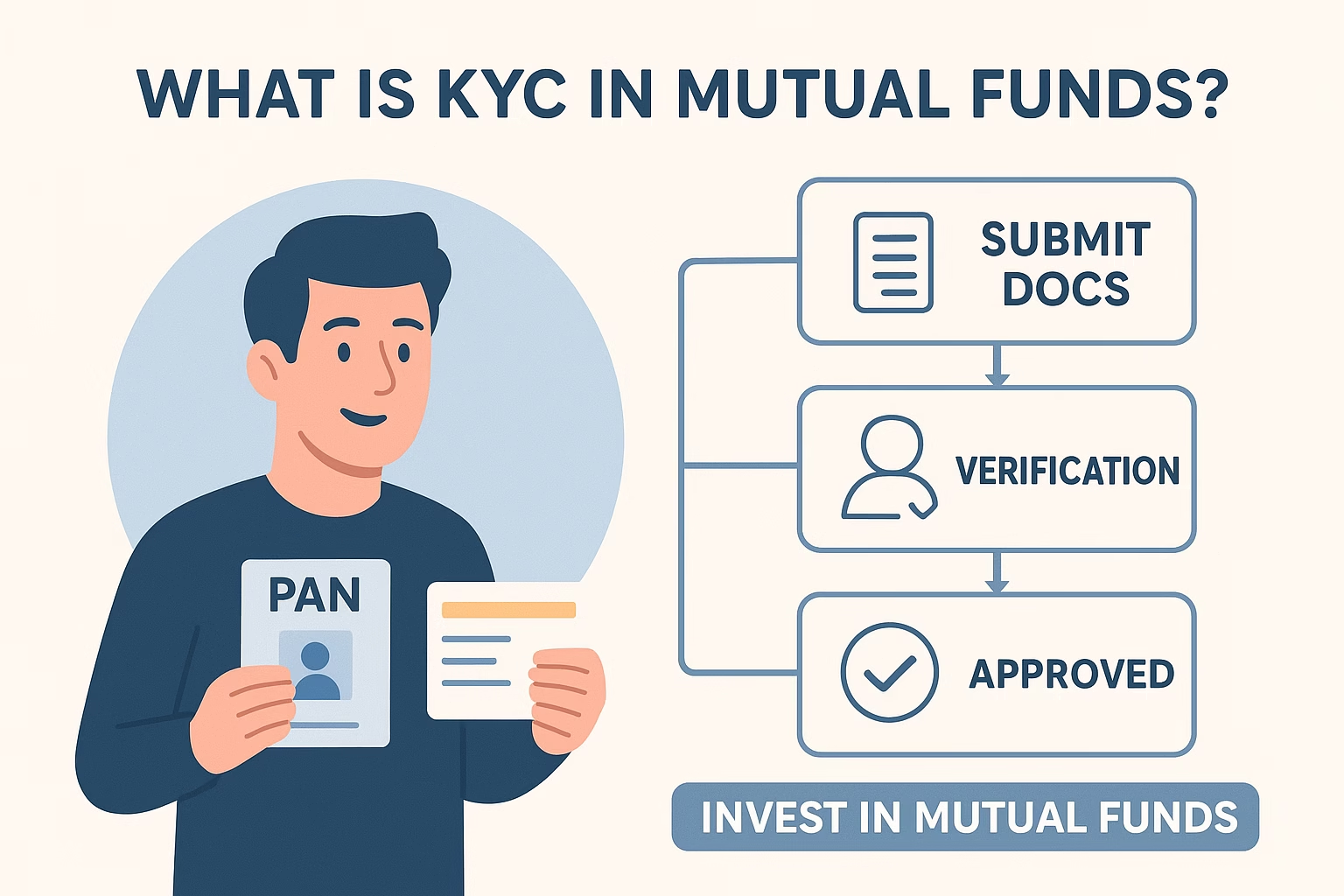

What is KYC in Mutual Funds?

Know Your Customer is a one-time verification process that establishes your identity and address before you can start investing in mutual funds. It requires you to submit certain documents and details which are verified by respective KYC Registration Agencies (KRAs) approved by SEBI.

Once this process is done, you can invest in any mutual fund scheme across any fund house—without repeating the process.

Why is it Mandatory?

- Regulatory Compliance – As per SEBI regulations, no financial institution can accept investments without verifying the identity of the investor.

- Fraud Prevention – Helps track genuine investors and prevents fraudulent activities.

- Anti–Money Laundering (AML) – Ensures transparency in financial transactions.

- Ease of Investment – This is a one-time process, henceforth you can invest in multiple mutual funds without fresh documentation every time.

Types of KYC for Mutual Funds

- Offline Process (Physical)

Done offline by submitting physical documents.

Requires in-person verification.

Valid across all AMCs and fund houses.

- e-KYC

Done online using Aadhaar and PAN.

OTP-based Aadhaar verification is common.

Limits may apply (e.g., ₹50,000 per year per AMC if Aadhaar OTP-based, unless biometric verified).

- CKYC

It’s a centralized customer verification record maintained by CERSAI (Central Registry of Securitisation and Asset Reconstruction and Security Interest of India). Once you complete this central verification with any financial institution (bank, NBFC, mutual fund, etc.), your details are stored in a single national database. You receive a 14-digit CKYC number, which can be used across all financial institutions — meaning you don’t need to redo the process separately everywhere.

Documents Required for Mutual Fund KYC

To complete the process, you generally need:

- PAN Card (Mandatory)

- Identity Proof and Address proof (POI and POA) (any one): Passport, Aadhaar, Voter ID, Driving License, NREGA job card.

- Photograph (passport-size).

- In-person verification (IPV) or video based verification (for online).

How to Complete KYC for Mutual Funds

Offline Process

- Download the form from a KRA (like CAMS, Karvy) or AMC website.

- Fill in personal details such as name, PAN, address, occupation, income range, etc.

- Attach self-attested copies of identity and address proofs.

- Submit the form to the AMC, KRA, or mutual fund distributor.

- Complete In-Person Verification (IPV).

- Once verified, you can start investing.

Online e-KYC Process

- Visit the website of a KRA, AMC, or mutual fund platform.

- Enter your PAN and Aadhaar details.

- Verify Aadhaar using OTP or biometric.

- Upload scanned copies of documents and photo.

- Complete video IPV if required.

- On approval, you’re ready!!

You can check your KYC status online via KRA portals like CAMS, Karvy, NSE KRA, or CVL KRA by entering your PAN number.

What Does Each Status Imply

Validated – You can do any transaction in any mutual fund, any time.

Registered – You can continue making transaction (like Purchases, redemptions, switches, SIPs etc) in all your existing mutual funds investment without any hassle. Only if you want to invest in a mutual fund where you don’t have any investment already, you will have to complete the verification process once again.

Under Process – Your application is being verified.

On Hold/Rejected – The status on mutual fund or RTA website, will show the reason for ‘on hold’/’rejected’ status, it could be: mobile or email not validated/PAN is not linked with Aadhaar/deficiency in submitted documents etc.

- For more details, please visit the Official AMFI website .

Common Issues in Mutual Fund KYC

Mismatch between PAN and Aadhaar details.

Invalid or expired documents.

Signature mismatch.

Failure to update your details after change in address, phone number, or email.

Benefits of Completing KYC Early

Quick start to your investment journey.

No delays in SIP registration or lump sum investment.

Hassle-free investments across all fund houses.

Future proof compliance for all mutual fund investment.

Final Thoughts

KYC is not just a regulatory requirement but also a safety measure that protects both investors and financial institutions. Completing this verification process is simple, one-time, and unlocks your path to disciplined wealth creation.

If you haven’t completed your this yet, it’s the right time to do so and begin your mutual fund investment journey smoothly.

For more insights on the latest verification process, check our next blog!!

- Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.This article is intended for educational purposes only and should not be considered as financial or investment advice.

For regular personal finance related updates do follow us on Instagram and Facebook .

For any queries Contact Us