When it comes to personal finance in India, your credit score (also called CIBIL score) acts as your financial report card.It plays a significant role in determining whether you are approved for a personal loan, home loan, car loan, or credit card. A good score also helps you get low-interest loans, higher credit card limits, and quick loan approvals.

Yet, many people are unaware of how important their CIBIL score in India really is. Let’s break down everything you need to know about CIBIL scores, CIBIL score range, factors affecting your score, and how to improve your CIBIL score fast.

What is a Credit Score?

A credit score is a 3-digit number between 300 and 900 that shows your creditworthiness. A higher score means you are financially reliable.

In India, your credit score is generated by CIBIL, Experian, Equifax, and CRIF High Mark. Lenders use this score to decide whether to approve your loans, credit cards, or mortgage applications.

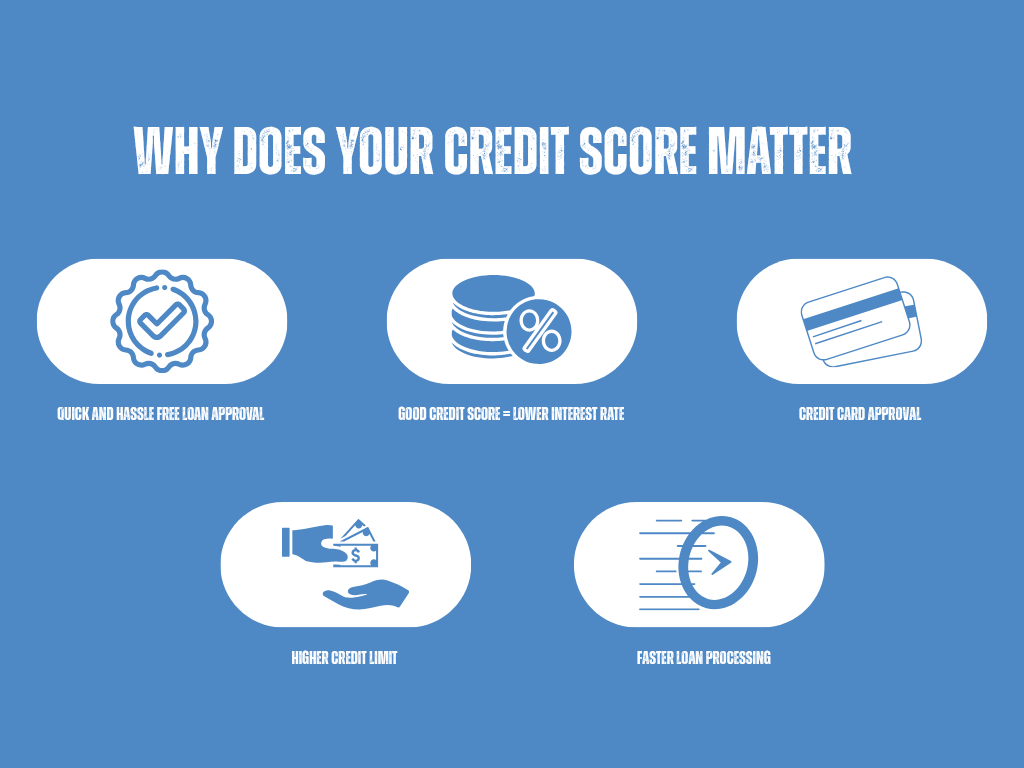

Why Does Your Credit Score Matter in India?

Your credit score is extremely important for your financial life:

- Loan Approvals – Banks and NBFCs are allowed to check your score before approving a personal loan, business loan, home loan, or car loan.

- Interest Rates – A good score = lower interest rates. A bad score = higher rates.

- Credit Card Approvals – Determines whether you get approved for a credit card, rewards card, or premium card.

- Higher Credit Limit – Banks trust you more if you have a high score.

- Faster Loan Processing – Strong CIBIL score = instant loan approval with less paperwork.

Credit Score Range in India (CIBIL Score)

750 – 900 (Excellent Score) → Instant loan approvals, best interest rates.

700 – 749 (Good Score) → Eligible for most loans and credit cards.

650 – 699 (Fair Score) → Loans possible, but with higher interest rates.

550 – 649 (Poor Score) → Difficult to get personal loans or credit cards.

300 – 549 (Very Poor Score) → Very high chances of rejection.

- Ideally, you should maintain a CIBIL score above 750 for better financial opportunities.

Factors That Can Affect Your Credit Score

Your credit score calculation is based on these key factors:

- Repayment History (35%) – Timely payment of EMIs and credit card bills is crucial.

- Credit Utilization Ratio (30%) – Using more than 30–40% of your credit card limit may lowers your score.

- Credit Age (15%) – The longer your credit history, the better.

- Credit Mix (10%) – Having both secured loans (like home loan, car loan) and unsecured loans (like personal loan, credit card) improves your score.

- Number of Credit Inquiries (10%) – Too many loan or credit card applications can reduce your score.

How to Improve Your Credit Score Fast in India

- Pay EMIs and credit card bills on time – Even one late payment can hurt your score.

- Keep credit card utilization below 30% of the limit.

- Don’t close old credit cards – Longer history = higher score.

- Maintain a mix of loans – A combination of secured and unsecured loans is ideal.

- Avoid multiple loan applications within a short time.

- Check your credit report regularly to correct errors in your CIBIL report.

- Improving your CIBIL score in India may take a few months, but consistent good habits will help you reach and maintain a score of 750+.

Final Thoughts on Credit Score in 2025

Your CIBIL score is not just a number—it’s the key to your financial future. A high score helps you get personal loans at low interest, instant loan approval, better credit card offers, and higher credit limits.

By following simple steps like paying bills on time, reducing credit utilization, and checking your CIBIL report regularly, you can steadily build and maintain an excellent credit score in India.

- Please note : If you notice any dispute in your credit history, such as loans that you haven’t applied or you are not aware of , report immediately to the respective credit rating agency. For more details Click here .

For regular personal finance related updates do follow us on Instagram and Facebook

For any queries Contact Us